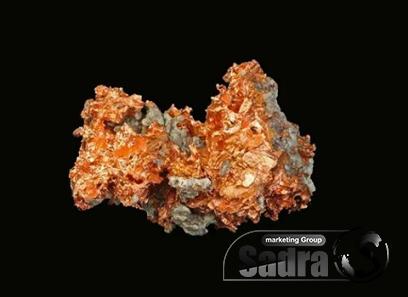

With its widespread use in infrastructure, electronics, and renewable energy systems, copper has become an investment opportunity worth exploring. In this article, we will delve into the impressive properties and applications of copper, its market outlook, and the potential for significant returns on investments. Properties and Applications: Copper boasts exceptional conductivity, malleability, and resistance to corrosion, making it ideal for various applications across different sectors. Its high thermal and electrical conductivity make it vital in electrical wiring and power generation systems.

.

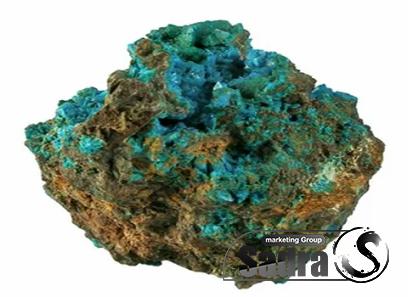

Moreover, copper’s anti-microbial properties make it suitable for medical devices and equipment. It’s also widely used in transportation, construction, and telecommunications industries, among others. Market Outlook: The demand for copper is on a steady rise due to its extensive use in renewable energy systems like solar panels and wind turbines. Furthermore, the growing popularity of electric vehicles (EVs) and the need for efficient energy transmission in smart grids have increased the global demand for copper. The increasing urbanization in emerging economies, such as India and China, also contributes to the rising demand for copper in infrastructure development. Investment Potential: Investing in copper can be a profitable venture due to its strong market fundamentals. Its increasing demand, limited supply, and the lack of substitutes make it an attractive long-term investment. In addition, copper often serves as a reliable indicator for global economic growth.

Moreover, copper’s anti-microbial properties make it suitable for medical devices and equipment. It’s also widely used in transportation, construction, and telecommunications industries, among others. Market Outlook: The demand for copper is on a steady rise due to its extensive use in renewable energy systems like solar panels and wind turbines. Furthermore, the growing popularity of electric vehicles (EVs) and the need for efficient energy transmission in smart grids have increased the global demand for copper. The increasing urbanization in emerging economies, such as India and China, also contributes to the rising demand for copper in infrastructure development. Investment Potential: Investing in copper can be a profitable venture due to its strong market fundamentals. Its increasing demand, limited supply, and the lack of substitutes make it an attractive long-term investment. In addition, copper often serves as a reliable indicator for global economic growth.

..

Its nickname, “Dr. Copper,” stems from its ability to predict business cycles. As the global economy recovers from the COVID-19 pandemic, the demand for copper is expected to soar. Investment Options: Investors can choose from several strategies to invest in copper. One option is to invest in copper mining companies, which stand to benefit from the rising demand and prices of copper. These companies offer exposure to the entire copper supply chain, including exploration, extraction, and refining. Another option is to invest in copper exchange-traded funds (ETFs), which provide exposure to the price movements of copper without directly owning physical copper. Additionally, futures contracts and options on copper provide avenues for sophisticated investors to hedge against price fluctuations.

Its nickname, “Dr. Copper,” stems from its ability to predict business cycles. As the global economy recovers from the COVID-19 pandemic, the demand for copper is expected to soar. Investment Options: Investors can choose from several strategies to invest in copper. One option is to invest in copper mining companies, which stand to benefit from the rising demand and prices of copper. These companies offer exposure to the entire copper supply chain, including exploration, extraction, and refining. Another option is to invest in copper exchange-traded funds (ETFs), which provide exposure to the price movements of copper without directly owning physical copper. Additionally, futures contracts and options on copper provide avenues for sophisticated investors to hedge against price fluctuations.

…

Risks and Considerations: As with any investment, there are risks to consider when investing in copper. Fluctuating copper prices, geopolitical tensions, environmental regulations, and supply disruptions can impact the profitability of copper investments. Additionally, investor sentiment and market volatility can lead to short-term price fluctuations. Therefore, it is important to conduct thorough research, diversify your portfolio, and consult with financial advisors before making any investment decisions. Conclusion: Copper presents a compelling investment opportunity in today’s world. Its exceptional properties and diverse applications across various industries make it a valuable and sought-after commodity. The growing demand for copper, driven by renewable energy projects, EVs, and infrastructure development, further solidifies its investment potential. With careful consideration of the risks and thorough market analysis, investors can potentially unlock significant returns through investments in copper.

Risks and Considerations: As with any investment, there are risks to consider when investing in copper. Fluctuating copper prices, geopolitical tensions, environmental regulations, and supply disruptions can impact the profitability of copper investments. Additionally, investor sentiment and market volatility can lead to short-term price fluctuations. Therefore, it is important to conduct thorough research, diversify your portfolio, and consult with financial advisors before making any investment decisions. Conclusion: Copper presents a compelling investment opportunity in today’s world. Its exceptional properties and diverse applications across various industries make it a valuable and sought-after commodity. The growing demand for copper, driven by renewable energy projects, EVs, and infrastructure development, further solidifies its investment potential. With careful consideration of the risks and thorough market analysis, investors can potentially unlock significant returns through investments in copper.

Your comment submitted.